Copper Falls to 8-Month Low on Concern Oil Slump Will Cut Costs

This article by Agnieszka de Sousa for Bloomberg may be of interest to subscribers. Here is a section:

Mining is an energy-intensive industry and lower oil costs have a deflationary impact on producers, according to Macquarie Group Ltd. Copper also declined as a strike was set to end at Peru’s Antamina mine, the world’s sixth-largest copper mine.

“Whatever positive connotations lower energy might have for global growth, the extent and pace of the decline in oil seems the more worrying factor for the moment,” RBC Capital Markets Ltd. said in a note.

Shale gas and oil are gamechangers for the energy sector has been a refrain here at FullerTreacyMoney since 2007. Just how much of a gamechanger is quickly coming into focus. Oil is by far the most globally significant commodity because of its utility, portability and energy intensity. Increasing global supply prompted by the high price environment represent a problem for traditional producers. Additionally, rising energy prices were a substantial component in the rising cost of producing just about all commodities.

Falling energy prices improve the economics of mining operations, allowing greater production. However, in a falling price environment this is not a positive factor. The medium-term result of falling energy prices will be to encourage economic growth and therefore demand but prices could easily fall further before a rebalancing is achieved.

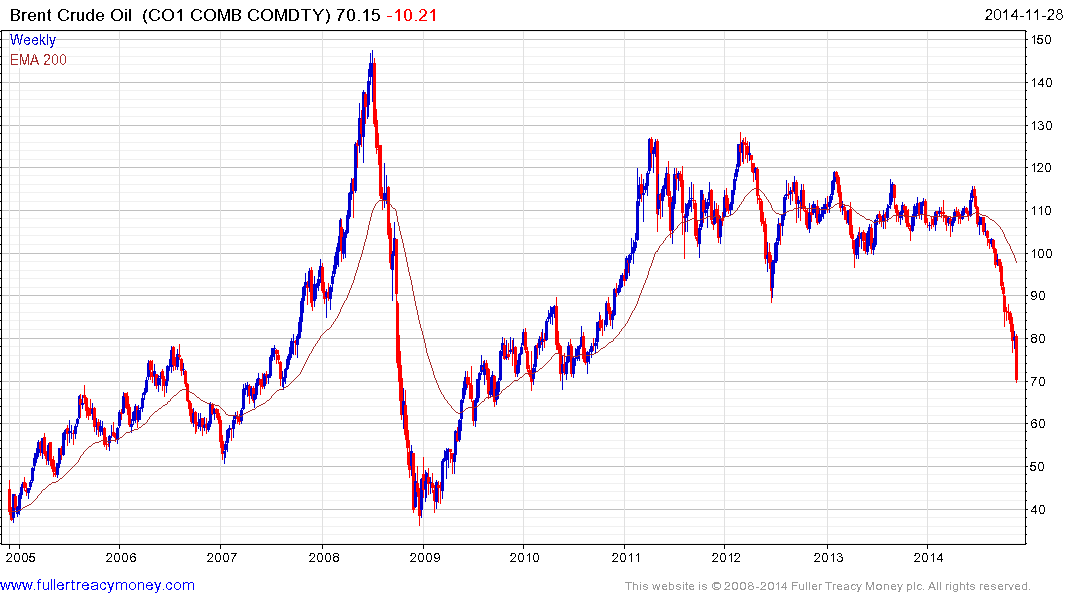

Brent crude extended its decline today, falling an additional $2.40. The five-month downtrend is now accelerating but a clear upward dynamic will be required to check momentum. Since the contract has not rallied by more than $4 since June, a rally of greater than $5 will be required to begin to question the integrity of the decline.

Copper prices have held a progression of lower rally highs since early 2011 but had stabilised near $3 for the last 18 months. Today’s downward break represents an extension of the medium-term decline and a sustained move above $3 would be required to begin to question potential for additional downside.

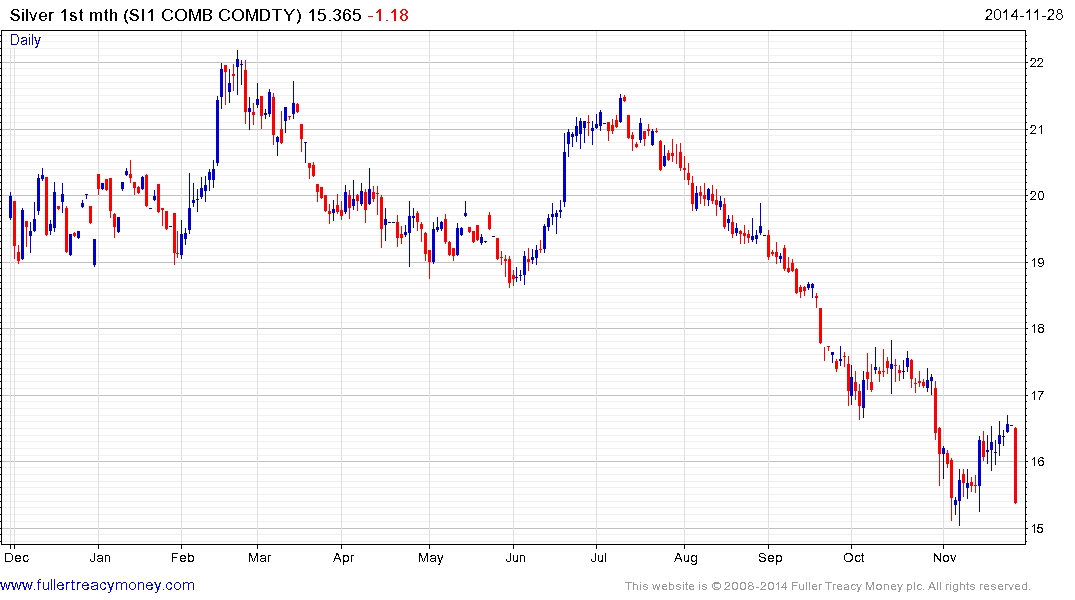

Silver’s more than $1 decline is now challenging the support building hypothesis and the $15 area will need to hold to give credence to a demand driven story.

Exxon Mobil is representative of the downward dynamics posted on US major oil producers following the Thanksgiving Day holiday. It will need to hold the mid-October low if a resumption of the four-month downtrend is to be avoided.

A number of service companies, such as Transocean extended their downward accelerations today and clear upward dynamics, sustained for more than a session or two, will be required to check momentum.

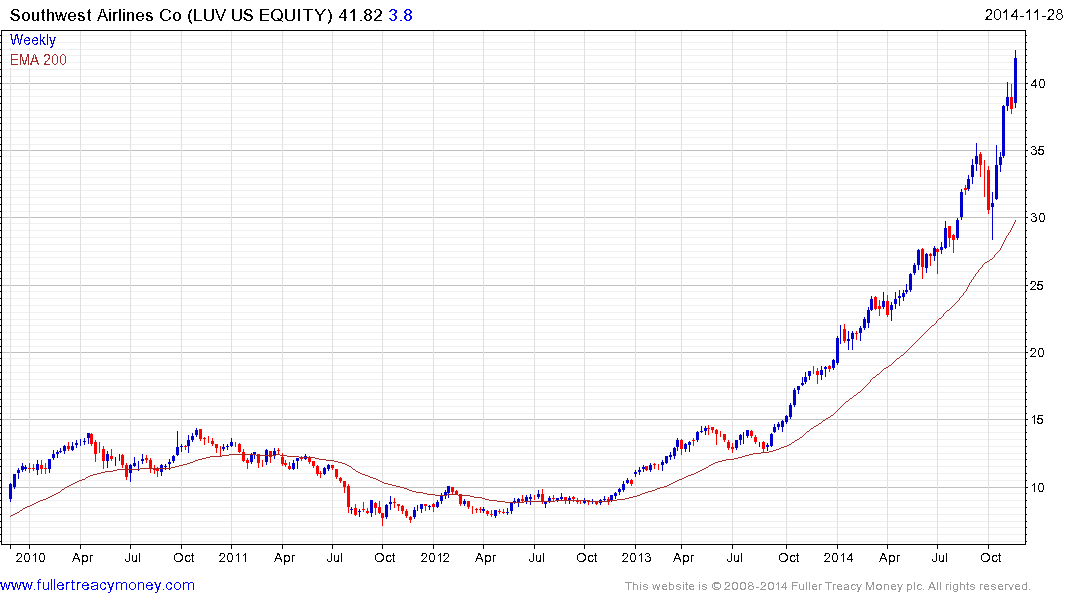

Lower energy prices couldn’t be better for airlines which continue to extend their advances albeit from already overextended levels. .

Back to top