Commodities Outlook 2015

Thanks to a subscriber for this report dated December 15th from Deutsche Bank which may be of interest. Here is a section:

The fundamentals of copper do not mirror that of oil. In copper, there is no technological breakthrough which has opened up vast new resources, therefore copper should not suffer the same fall in pricing as that of oil. The fallout from oil has however impacted the overall sentiment towards commodities. However, copper remains a well-supplied market, and a lower oil price in combination with weaker producer currencies will lower the marginal cost support level, which we now estimate at USD5,800/t.

We continue to forecast a surplus market in copper for 2015E and 2016E, which in our view will see prices grind lower. However, we have cut the magnitude of the surpluses in both 2014 and 2015E by 200kt over the course of the year. The big increase in mined supply growth that we had previously forecast has been eroded by the latest round of downgrades to company guidance. Although we forecasts a more substantial surplus in 2016, we think risks are skewed to the downside, given the poor industry track record in delivering growth.

Here is a link to the full report.

Energy represents a significant cost for mining companies and has been a major contributor to the commodity price inflation witnessed over the last decade. One might expect lower energy prices to be a benefit for mining companies and they are. However the hard reality is this only helps marginal producers to survive longer and therefore prolong the supply surplus.

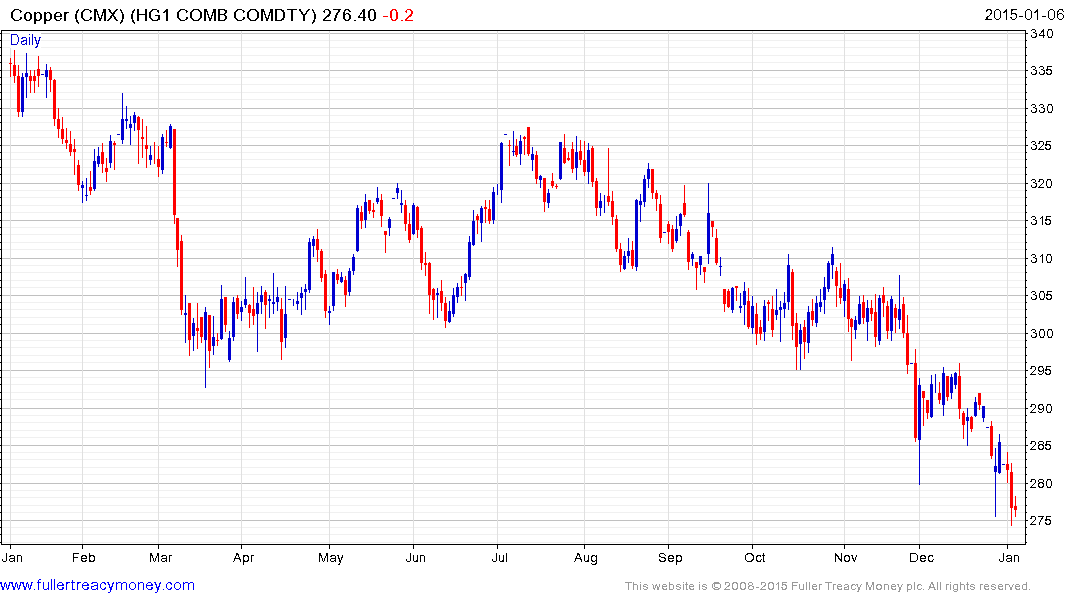

Oil prices are accelerating lower so energy costs for mining operations have halved since the summer. This has contributed to the recent weakness in the industrial metal prices. The LME Metals Index broke downwards to new three-year lows this week and a clear upward dynamic would be required to check potential for additional weakness.

.png)

Copper has sustained the move below $3 posted in late November and a break in the progression of lower rally highs, currently near $2.95, would be required to question the consistency of the decline. Personally, the entry point on my short is below that level and I have introduced a stop to avoid a loss in the event of a meaningful rally.