Colombian President Says No One is Above the Law as Son Charged

This article from Bloomberg may be of interest to subscribers. Here is a section:

Colombian President Gustavo Petro said that an investigation into whether his son took money from organized crime must be allowed to follow its course, since “no one can be above the law.”

A prosecutor said Thursday that Petro’s eldest son Nicolás put some of the tainted money to his father’s successful 2022 campaign and kept some of it for himself.

Gustavo Petro, center, waves to supporters alongside his son Nicolas Petro Burgos, right, on election night in Bogota, Colombia, on May 29, 2022.

The scandal is likely to further weaken the leftist government’s ability to pass its radical health, pension and labor reforms, and may also hurt its performance in upcoming regional elections in October.

“The Petro administration lost a lot of leverage with this,” said Sergio Guzman, the director of Colombia Risk Analysis, a Bogota-based consultancy. “It was going to have a difficult time to move things through in congress, but this makes it all the more difficult.”

Even so, people who think Petro is now finished are “jumping the gun”, Guzman said.

Investors often welcome developments that hinder Petro’s welfare reforms, fearing these will blow out the fiscal deficit. The peso was 1.9% stronger at 10.40 a.m. in Bogota, the best performance in emerging markets.

The point that immediately came to mind is seeing the above story. The first is how many leaders in the so-called developed world would be willing to allow their son to stand trial for corruption? My suspicion is it would be dealt with well before it ever became mainstream news.

The Peso is testing the region of the 1000-day MA and pulled back this week in response to rate cuts from both Chile and Brazil. The balance of probabilities is several South American countries will soon follow suit. That could result in a period of weakness for the currency.

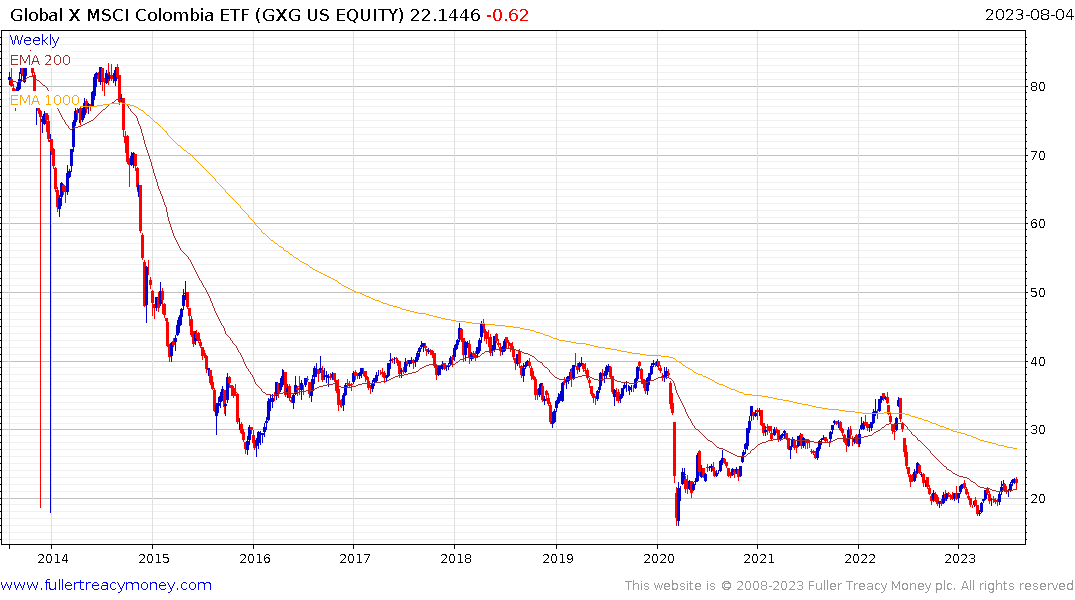

The Global X Colombia ETF paused this week at the upper side of a six-month range. It has been steadying in the region of the 2020 lows but a bullish catalyst in the form of stronger growth or higher oil and industrial commodity prices.

Ecopetrol (Est P/E 4.7, DY 7.3%) is firming from the lower side of a nine-year base formation.

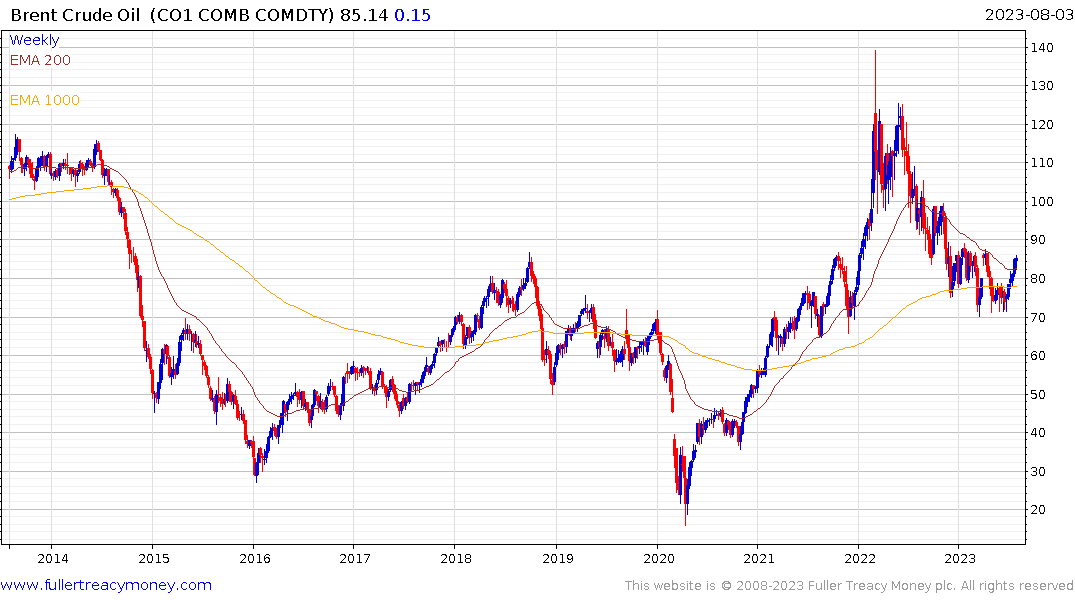

Brent Crude continues to extend its rebound and has broken the medium-term downtrend.