Cobalt price: Congo production surges

This article by Frik Els for Mining.com may be of interest to subscribers. Here is a section:

Supply risks for cobalt are centred on the Democratic Republic of the Congo which is responsible for two-thirds of world output. And the country’s share will only increase over the next five years as Chinese investment in new mines come on stream.

The central African nation's output of cobalt – as a byproduct of copper production – is already soaring as top producer Glencore's operations in the country ramps up again after a refurbishment period.

The DRC produced 296,717 tonnes of copper in the first quarter of 2018, up 8.2% over the same period last year, the central bank said in a report on Thursday. Cobalt production in the first quarter of 2018 rose 34.4% to 23,921 tonnes. Global production last year was around 117,000 tonnes.

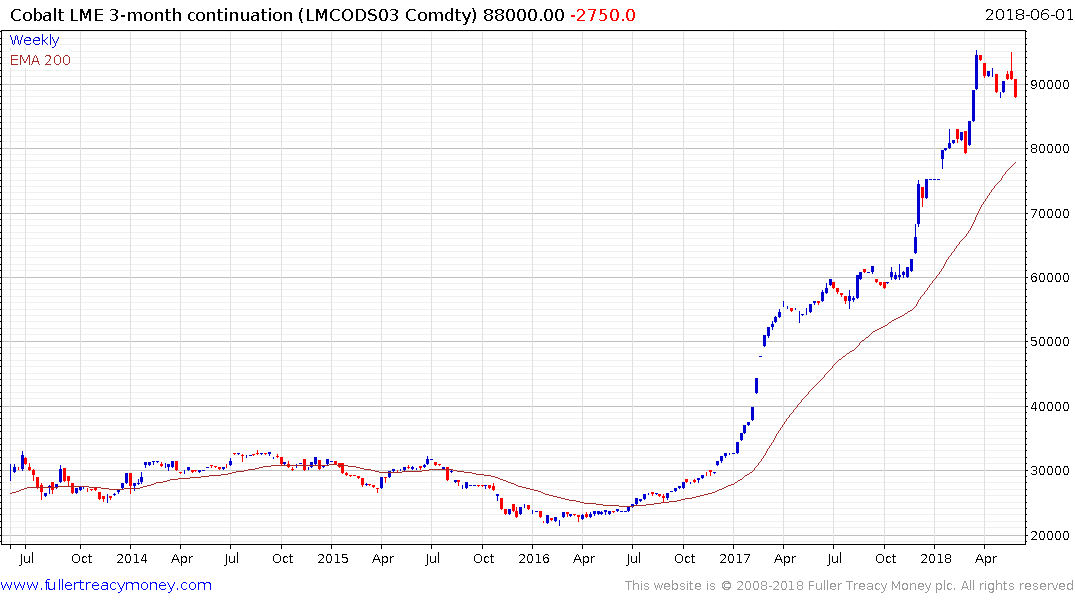

The oldest adage from the commodity markets is the cure for high prices is high prices. Cobalt is up 400% already so on the supply side there is real pressure to increase supply. On the demand side consumers are investing heavily in coming up with new chemistries to reduce cobalt intensity.

That is a recipe for prices to correct and break in the progression of higher reaction lows would confirm a peak of medium-term significance.

Meanwhile the evolution of 8:1:1 nickel:manganese:cobalt chemistries from 2:1:1 greatly enhances the intensity of nickel sulphide use in batteries. The metal sat out the recovery for industrial metals prices in 2016 but is now playing catch. The majority of nickel produced today is not of high enough quality to serve the battery sector so that suggests the supply deficit for nickel sulphide will not easily be resolved.