Canada Faces Era of Pipeline Abundance After Keystone Move

This article by Robert Tuttle for Bloomberg may be of interest to subscribers. Here is a section:

More pipelines from Canada would also “generate greater competition for crudes of comparable quality such as those imported from Mexico or Venezuela,” Harry Tchilinguirian, head of commodity-markets strategy at BNP Paribas SA in London, said in an instant message.

The administration moved to expedite approval and construction of the Keystone XL pipeline as well as the Dakota Access line through North Dakota. Trump said he wanted to renegotiate terms to get a better deal for the U.S., including more U.S.-made materials in the lines.

The 830,000-barrel-a-day Keystone XL has been blocked since it was first proposed in 2008. TransCanada said in a statement it will reapply for the project.

Canada represents a problem for OPEC. It has vast reserves which are largely economic at today’s prices and it borders the world’s largest consumer. Despite that proximity its tar sands have been stranded, inhibited by lack of access to key global markets, which has made Canada something of a bit player in the global market. With the development of pipelines

West, East and South that could all change in the coming decade.

Suncor Energy bounced this week from above the trend mean as it continues to test the upper side of a seven-year base formation.

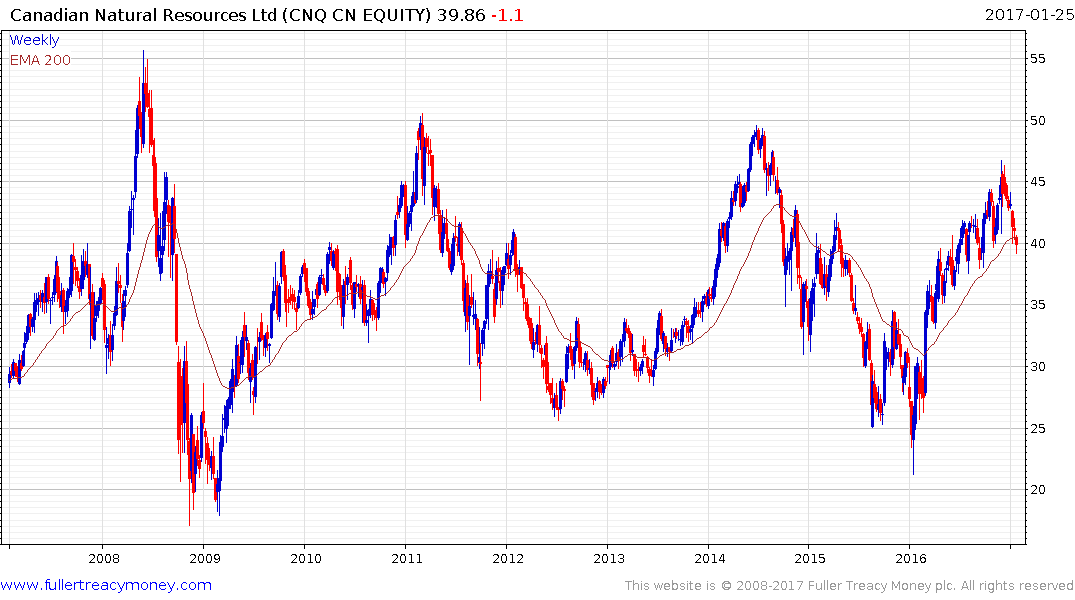

Canadian Natural Resources has been subject to bouts of acute volatility over the last decade but is now testing the region of the trend mean and a sustained move below it would be required to question potential for continued higher to lateral ranging.

Imperial Oil is testing the region of the trend mean following a steep pullback over the last six weeks. It will need to hold the $44 area to confirm support in this area.

Among other Western Canadian energy companies Paramount Resources continues to hold a progression of higher reaction lows and is now firming from the region of the trend mean.

Tourmaline Oil dropped below its trend mean a few weeks ago and will need to sustain a move back above it to begin to signal a return to demand dominance beyond short-term scope for steadying.

This article highlights the return of drilling activity in the Canadian oil patch with prices trading in the region of $50.

Back to top