Bull Market Losing Big Ally as Buybacks Fall Most Since 2009

This article by Lu Wang for Bloomberg may be of interest to subscribers. Here are two sections:

The first-quarter slowdown was mostly executives responding to the economic and credit stress earlier in the year, according to Joseph Amato, chief investment officer of equities at Neuberger Berman LLC in New York, where the firm oversees $243 billion. As the fear subsides, buybacks are likely to stay elevated, he said.

“The scare in the first quarter was overblown,” Amato said. “The economy is growing on the global basis at a reasonable level. That, in our mind, would suggest that companies will come back and have a typical buyback program consistent with levels of the last few years.”

And

Their role in keeping the bull market afloat is more pronounced this year. According to Bank of America Corp., the firm’s trading clients from hedge funds to wealthy individuals were net seller of stocks for 15 straight weeks through May 6, a record streak. The only buyer was corporations scooping up their own shares.

“Companies have been a fairly consistent buyer that has supported the late stage of this bull market,” Channing Smith, a managing director at Capital Advisors Inc. in Tulsa, Oklahoma, said by phone. The firm oversees about $1.6 billion. Their potential retreat means “there is less firepower to counter any type of bout of selling,” he said.

I devoted a lengthy discussion in the Subscriber’s Audio on Friday to the role of buybacks in both supporting the market and manipulating valuations by decreasing EPS. Anything that impinges on companies buying back their shares represents a challenge for the market. Corporations have been the primary driver of demand for shares and buybacks have been an important artery for the transmission of central bank liquidity.

The decline in corporate profitability remarked upon in the above article is a major consideration for companies because with declining profits hard decisions have to be made about where available funds are allocated. The 2nd quarter should be better for oil companies and they continue to lead the market higher. That sector should also be more active in pursuing buybacks and takeovers.

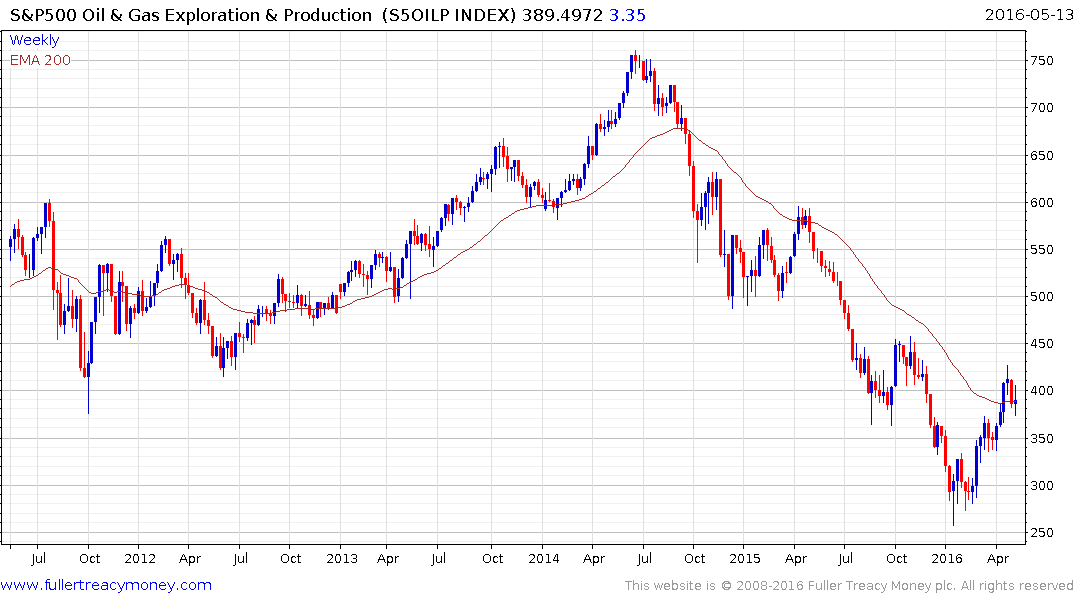

The S&P 500 Oil & Gas Exploration & Production Index dropped 66% between 2014 and January. It has now closed the overextension relative to the trend mean and continues to consolidate around 400. A break in the short-term progression of higher reaction lows, currently near $375, would be required to question potential for additional upside.