Brent Crude Declines Below $100 for First Time Since June 2013

This article by Mark Shenk for Bloomberg may be of interest to subscribers. Here is a section:

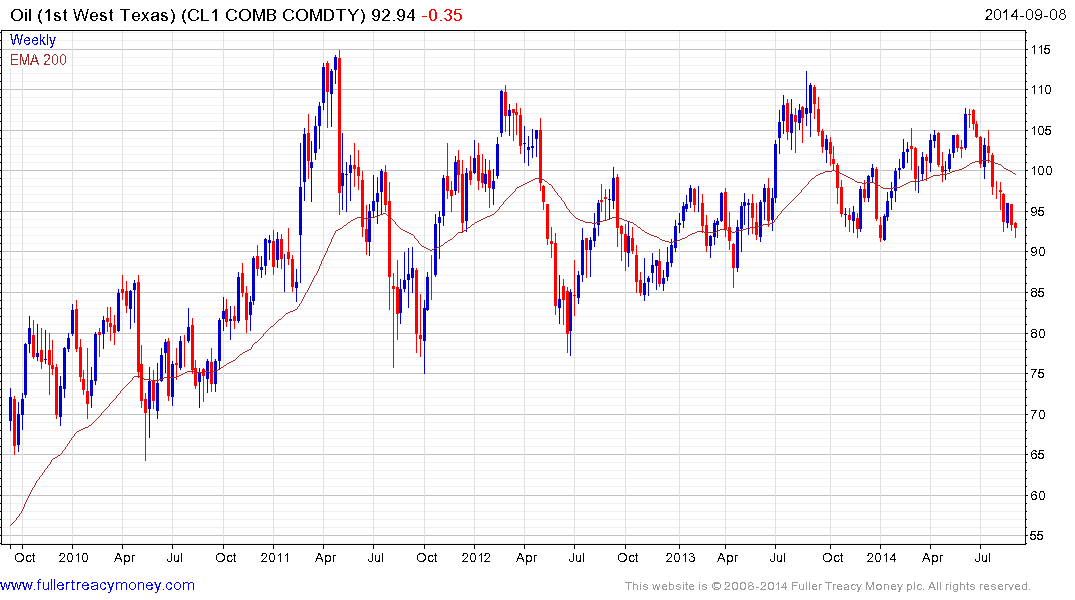

WTI for October delivery fell 98 cents, or 1.1 percent, to $92.31 a barrel on the New York Mercantile Exchange. Futures touched $91.80, the lowest level since Jan. 14. Volumes were 8.6 percent higher than the 100-day average. The U.S. benchmark grade traded at a $7.52 discount to Brent, compared with $7.53 at the close on Sept. 5.

“The fundamentals have been bearish and eventually the fundamentals win out,” Sarah Emerson, managing principal of ESAI Energy Inc. in Wakefield, Massachusetts, said by phone. “We’re looking at a weak global market.”

In China, imports fell for a second month as a property slump hurt domestic demand. The trade surplus climbed to a record of $49.8 billion in August as exports rose on the back of increased shipments to the U.S. and Europe.The 2.4 percent drop in imports compares with the median estimate for a 3 percent increase. Exports increased 9.4 percent from a year earlier, the Beijing-based customs administration said today, compared with the 9 percent median estimate in a Bloomberg survey.

Brent Crude closed out the day close to $100 which has represented an area of support on successive occasions since 2011. Demand growth might be moderating but supply constraints are what helped prices maintain elevated prices over the last few years. This situation is easing as US production displaces imports and as some of the missing Middle Eastern barrels begin to come back to market.

Quite what Saudi Arabia does at this price point is likely to be the deciding factor in whether Brent crude finds support in the $100 area. It could maintain current production rates in an effort to keep the market stable as events continue to unfold in Iraq or it could pursue narrow self-interest by withdrawing some supply to support prices. A break in the three-month progression of lower rally highs will be required to confirm a return to demand dominance beyond some short term steadying.

West Texas Intermediate has also held a three-month progression of lower rally highs and has returned to test the $90 area. This represents where one would expect demand to return if the progression of incrementally higher reaction lows within the medium-term range, evident since 2011, is to remain intact.