Boeing Plans Full Drawdown of $13.825 Billion Loan

This article by Paula Seligson for Bloomberg may be of interest to subscribers. Here is a section:

Boeing obtained the loan from a group of banks last month to help it deal with its cash burn while it prepares to return its 737 Max plane to the skies. It initially tapped about $7.5 billion of the debt, and is now expected to draw the rest, said the people, asking not to be named discussing private information. Boeing plans to draw the remainder of the loan as a precaution due to market turmoil, one of the people said.

Companies affected by the virus are increasingly turning to banks for short-term financing to provide a safety net. United Airlines Holdings Inc. raised $2 billion in new liquidity with a secured term loan, while Norwegian Cruise Line Holdings Ltd. recently signed a new $675 million revolver. Should credit conditions worsen, more firms may start to draw down their credit lines, market watchers say. Boeing’s loan came about before Covid-19 spiraled into a global crisis and was expected to be fully drawn eventually.“They want to have cash on the balance sheet,” said Bloomberg Intelligence’s Matthew Geudtner. The Max grounding, the company’s joint venture with Embraer SA and looming debt maturities will also weigh on Boeing’s cash hoard, he said.

The easiest way to determine where the biggest risks reside in this market is to use this metric: Whatever people were worried about in 2019, the coronavirus makes things worse.

Boeing’s planes started falling out of the sky a year ago and they are still not in a position to say the engineering issues that led to that calamity have been resolved. Meanwhile, it is going to be a while, to say the least before anyone is buying planes again.

Boeing drawing down the maximum from its credit line is testament to just how impacted its balance sheet. Airlines were firmer yesterday because they did the same but the bigger point is they are seeing bookings collapse. Boeing may need a government bailout before the full extent of its troubles are priced in.

Meanwhile in the fintech sector Robinhood maxed out its credit line last month. Since it was among the most successful providers of market access to a new crop of retail investors its liquidity situation is worth monitoring, not least as platform outages have increased over the last week.

.png)

This widely circulated image from a customer support page highlights the difficulty of dealing with retail clients in a falling market.

The issues investors were worried about last year include: stagnant corporate profits and rising valuations, leverage and lack of profits in the unconventional oil and gas sector, moderating growth and high property prices in China, property bubbles in Australia, Canada and parts of Europe and the prospect of highly leveraged corporate balance sheets leading to significant downgrades into junk. All of these issues are not clear and present dangers as the coronavirus interrupts cashflows.

The S&P500 is now in the region of the 1000-day MA. This is where it needs to bounce is the 11-year uptrend is to have any semblance of consistency.

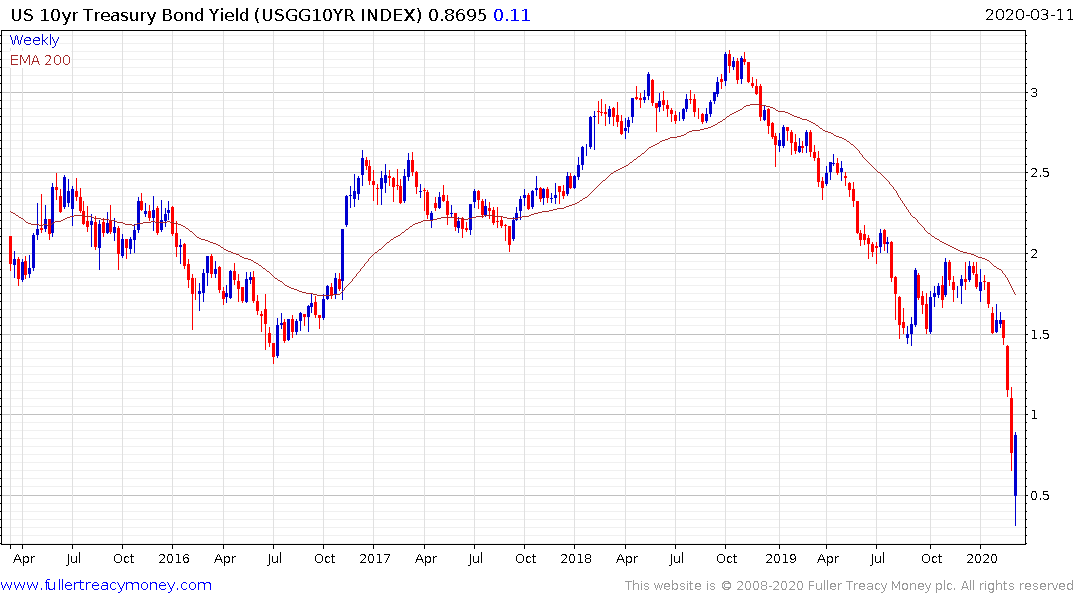

While stocks have yet to find a bottom, Treasuries look increasingly likely to have encountered near-term resistance. Bond prices falling with stocks is going to play havoc with traditional 60/40 portfolios if it persists. That is supportive of the view there is a wider liquidity issue evolving where the security of bonds cannot be guaranteed. This relationship is perhaps the most important to monitor.