Bloated with Gas

Thanks to a subscriber for this contemplative report from Deutsche Bank examining the LNG sector and its potential for growth. Here is a section:

There is a positive: capex likely much reduced, trading volumes enhanced

Today c15-20% of major IOC capex is on LNG developments. We think much will be deferred in 2015/beyond, potentially a material $10bn plus curb on near term IOC capex. For those with trading businesses (BP & BG) greater access to US volumes gives an attractive, low capital, source of annuity cash flow.Other industries?

For Europe, by 2022 70bcm (15% of supply) could come from the US, potentially cutting Russian dominance of Europe markets (to 22% from 33% now) unless significant ground is ceded on price. For European Oil & Gas E&C companies the shift in build to the US represents another nail in their coffin. Euro utility? Falling spot gas helps affordability but curbs UK power margin.Why bother writing this report?

LNG matters to the IOCs: long-lived, low maintenance it grows towards 20% of operating cash flows by 2020. With the downstream pressured, this shift has been central to the rebuild of cash cycles at Shell, Total, Chevron and Exxon. Relative winner? BP. A price disrupter and less dependent on Asia, BP is long US gas and short European, a positive given the likely trade flows.

Here is a link to the full report.

A number of the international oil companies (IOCs) have been producing more gas than oil for a number of years which is why they report reserves on an energy parity basis. Chief among these are Exxon Mobil and Royal Dutch Shell. There is no doubt that the US has the gas necessary to supply a substantial portion of the global LNG market but it is questionable at what price this can be achieved and whether today’s wide arbitrage will be sustained once US gas starts to be exported.

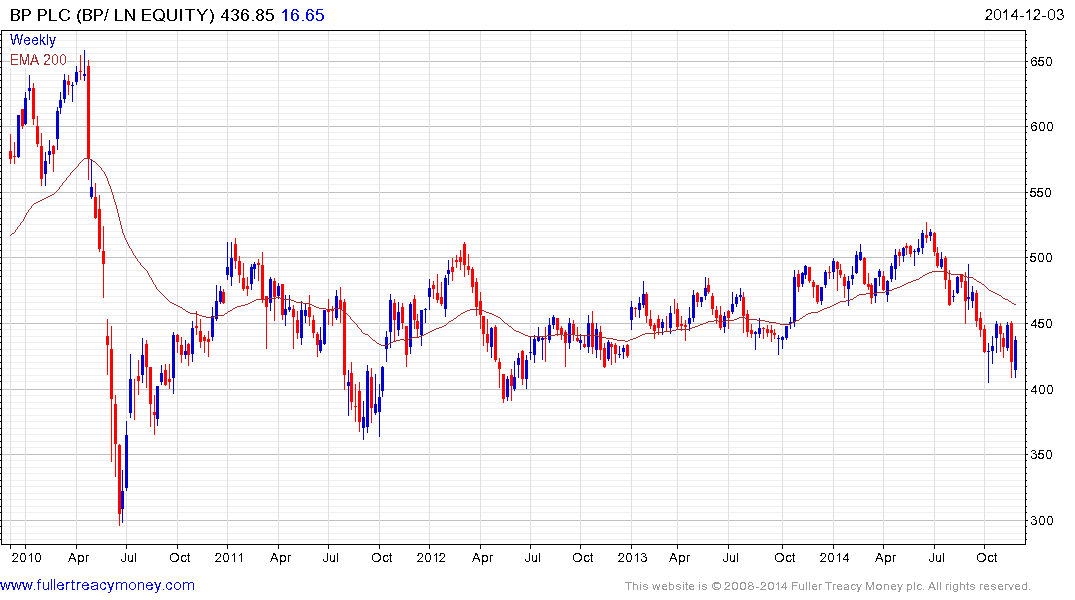

BP (Est P/E9.96, DY 6.42%) has firmed in the region of 400p and a sustained move below that level would be required to signal a return to supply dominance.

Back to top