BHP, world's largest miner, says 2017 is 'tipping point' for electric cars

This article by Clara Ferreira-Marques and Gavin Maguire for Reuters may be of interest to subscribers. Here is a section:

Balhuizen said he expected the electric vehicle boom would be felt - for producers - first in copper, where supply will struggle to match increased demand. The world’s top mines are aging and there have been no major discoveries in two decades.

The market, he said, may have underestimated the impact on the red metal: fully electric vehicles require four times as much copper as cars that run on combustion engines.

BHP, Balhuizen said, is well-placed, with assets like Escondida and Spence in Chile, and Olympic Dam in Australia. BHP said last month it was spending $2.5 billion to extend the life of the Spence mine in northern Chile by more than 50 years.

Copper is currently in contango suggesting a short-term supply deficit is not what has driven prices higher over the last couple of months. The outage at Escondido which restricted supply was a consideration that contributed to the gain but was not enough to push the futures curve into backwardation. Enthusiasm about the demand vector electric vehicles represents for metals like copper, nickel, lithium and cobalt could be a better explanation despite the fact these represent medium rather than short-term considerations.

Comex Copper hit a recent peak near $3.20 earlier this month and a mean reversion pullback is now underway. The price is now approaching the region of the trend mean and the upper side of the underlying trading range, so this is a natural area to begin to question where support is likely to be found. That assumes of course the medium-term uptrend is going to remain reasonably consistent.

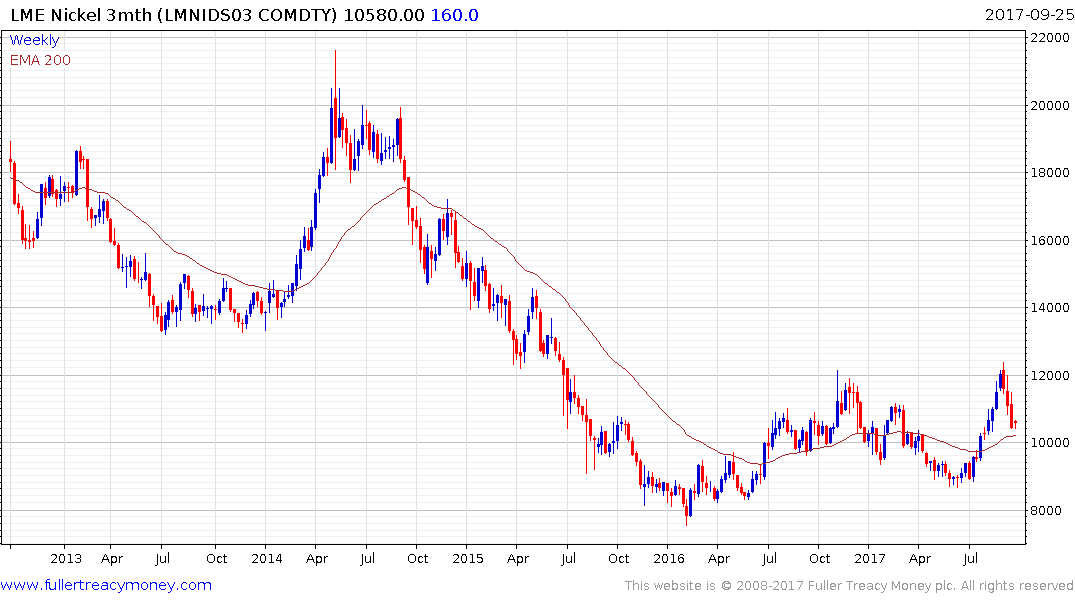

Nickel pulled back sharply from its early September peak and is testing the psychological $10,000 level once more. If support is to be found this represents where some investors may have bids in the market.

Unfortunately, I can’t get access to an up to date price of lithium but, by all accounts, it remains close to historic highs.

FMC Corp has surged higher this year but is now susceptible to at least some consolidation of what has been a powerful gain.

.png)

Cobalt surged higher this year but has lost momentum of late.