Australia's Pensions Suffer Worst Year Since Financial Crisis

This article from Bloomberg may be of interest to subscribers. Here is a section:

Australia’s pensions posted their worst annual performance since the global financial crisis as markets were roiled by central banks’ aggressive rate hikes and the war in Ukraine.

Guardians of the world’s fifth largest pension pot shed A$92.8 billion ($64 billion) on investments in the fiscal year through June 30, the biggest loss for the period since 2009, according to Australian Prudential Regulation Authority data released Tuesday. That saw the pool of savings fall to A$3.3 trillion, wiping out a year’s growth.

The performance was largely due to a A$140 billion loss in the June quarter as equity markets were roiled by fears of a slowing global economy. The funds had boosted their stocks allocations toward the end of last year, before global equity markets slumped following Russia’s war in Ukraine and central banks’ efforts to stamp out rampant inflation.

Australia’s pensions are bracing for more volatility in anticipation that the global economy could be heading into recession. They’ve lifted their holdings of fixed income and cash, while their stock allocations are now at the lowest level since December 2020.

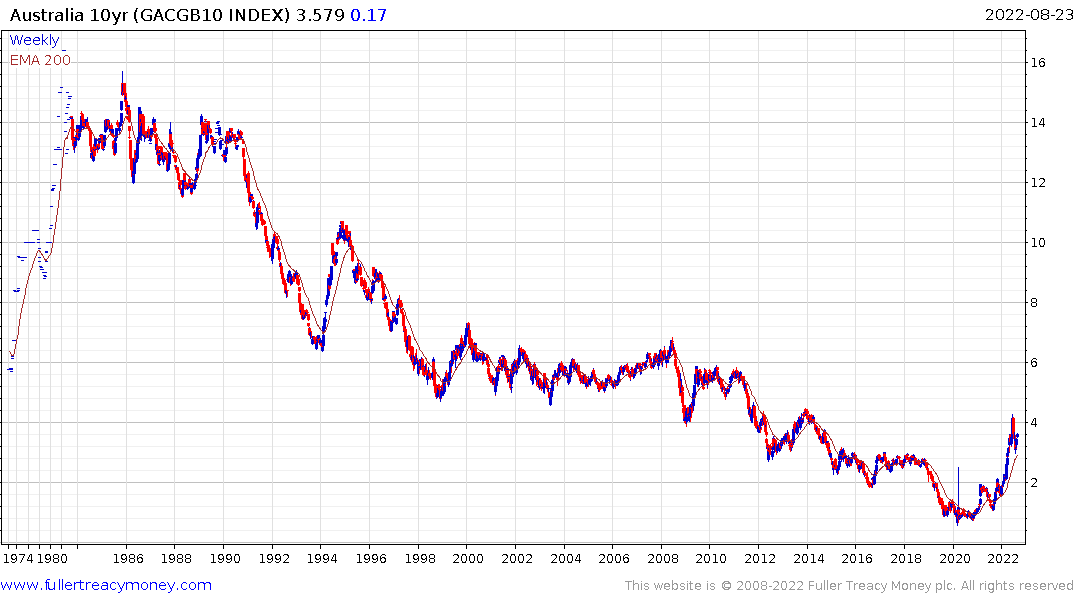

Australia’s pension system is the envy of anyone who cares to look at such things. However, that does not insulate it from the universal challenge of bonds and equities falling in tandem. That’s something every pension fund has had to contend with this year. The biggest question by far is whether this is an anomaly or something we should be prepared to deal with for much of the next decade?

The biggest theme for stock market and bond bulls has been the fountain of liquidity pouring from central banks for the last fourteen years. That has compressed yields and boosted stock valuations of companies that make the best use of cheap capital.

As liquidity becomes more expensive it favours the outlook for companies that have clear visibility on revenue growth. Those are necessarily more defensive sectors like pharmaceuticals, consumer staples and energy (for as long as prices are rising).

As liquidity becomes more expensive it favours the outlook for companies that have clear visibility on revenue growth. Those are necessarily more defensive sectors like pharmaceuticals, consumer staples and energy (for as long as prices are rising).

The caveat is when a convincing argument for the outperformance of defensive sectors is widely accepted by investors, it is generally a very late-stage phenomenon. That suggests the potential for a deep recession to correct the anomalies in the market is becoming progressively more likely.

Let’s pick apart the three main themes affecting today’s market. The surge of liquidity during the pandemic was designed to support demand. It worked. China’s exports surged to new heights and, even then, could not keep up with orders. The supply bottlenecks are as much about outsized demand as an inability to keep up or expand quickly enough to avoid bottlenecks.

The lack of investment in both onshore and offshore oil supply over the last half decade has placed control of the market back into the hands of OPEC+. They have every incentive to support prices at close to record levels.

On a related matter, how essential natural gas is to the industrial, utility and crop science sector is becoming increasingly obvious as prices rise. The war in Ukraine has made natural gas a weapon unlike anything seen in the energy markets since the 1970s. In stark terms, it highlights why wars are inflationary. That puts energy exporters like Australia, Canada and the USA in a stronger position than importers.

Raising rates and reducing the size of central bank balance sheets will help correct the excess demand issue, albeit in a painful manner. Much greater investment in additional supply and transportation infrastructure for both oil and gas will be required to reduce prices on a sustained basis. There is not much appetite for that, with so much focus on climate change in the media. The recipe of surging energy prices and tighter liquidity will result in a deep recession. The only real question is how global it will be.

Back to top