2016 Oil Market Outlook

Thanks to a subscriber for this report from DNB which may be of interest. Here is a section:

In addition to a still over supplied global liquids balance it is of course bearish that OPEC does not look set to change their output policy in the December 4 meeting. The change in Saudi policy was one of the key reasons why we held the most bearish view to oil prices in the surveys one year ago. We were early to identify 1986 as the relevant comparison since this downturn is a supply led downturn and not a demand led downturn. Hence it made no sense to us that Saudi would defend oil prices this time, since the kingdom always has seen the 1980-86 cut period as a mistake. We do not foresee a change in the Saudi tactics in the December 4 OPEC meeting since there are very visible signs that the policy is working, first and foremost through the large global CAPEX cuts hitting shale, deepwater and Canadian oil sands.

It is also important to emphasize that we are still in a situation where there will be no contributions to a potential OPEC production cut from other than Saudi/UAE/Kuwait. Iran, Iraq and Libya is of course totally out of the picture to contribute, and how can Venezuela, Nigeria and the other OPEC countries cut back output voluntarily when their domestic economies needs the exports revenues? Since there is no sanctions on any OPEC country that does not follow the potential new quota, how can Venezuela trust that Nigeria is cutting any output?? The risk would be that Venezuela cuts and it is too small to affect the price and then revenues are falling as the exports volume is reduced. OPEC behaviour is still a lot of game theory… To us this means that the only way we could see an OPEC cut in the December meeting would be that Russia contributes to cutting production. We do not see this as very likely, noting the statements from for example the Russian Deputy Energy Minister in October where he said that Russian oil wells are mostly located in harsh climate in Siberia which means the wells will not be easy to restart after having been shut down and there is no storage capacity for the crude Russia would otherwise have exported.

On October 21 OPEC and some non-OPEC countries held a meeting with technical experts to discuss the oil market but the meeting gathered no interest from non-OPEC countries to contribute to any production cuts. Venezuela has proposed to reapply a new price band for OPEC where production should be reduced when the price is below a 70 $/b threshold but has seen little traction so far on this idea. The response from the Saudi “pump-king” Al-Naimi was that “only the market can decide on prices, no one else”, so it does not look promising for Venezuela which will just have to tighten their belts.For OPEC it just makes it even more difficult that Iran is set to return to the market in 2016. IAEA must verify that Iran has implemented the nuclear agreement before sanctions can be removed. Iran must reduce the number of centrifuges from 9.500 to 5.060, move installed non-operating centrifuges into storage, dilute stock pile of low-enriched uranium from 10.000 kg to 300 kg, remove the core Arak heavy water reactor and establish verification systems across the supply chain. Iran’s supreme leader has stated that the process at Arak will not begin until the IAEA completes its investigation on past nuclear weapons work and that report is not due until December 15. We have hence factored in that the sanctions are not removed until the second quarter of 2016 in our global supply/demand balance.

Here is a link to the full report.

There are large number of moving parts in the global energy sector and the number of potential wild cards that could have a major influence on prices has increased. At this stage it is a philosophical question whether the low price environment has led to increased risk but there is no denying that wars on the periphery of some of the world’s biggest oil producing areas is a risk. The piece in the above report focusing on the palace politics of Saudi Arabia is also worth keeping an eye on because of the influence regime change could have on energy policy.

Early decline rates in unconventional oil and gas wells were seen as a headwind to the sector five years ago but could in fact lead to the redemption of the shale oil sector. In a low price environment drilling stops, wells hit their production peak and supply decreases. When prices rise back up to attractive levels drilling picks up and supply increases. This relatively swift supply response to the oil price is not something conventional wells can provide and suggests that in the current low price environment supply will fall but it would be rash to conclude it cannot ramp up again following any rally.

Refracking is still an emerging technology but holds the potential for drillers to go back over previously fracked ground to revitalise wells that have seen their production peaks and for a much lower cost than the original well. Obviously setting off bombs miles underground has to be approached with a certain degree of caution not least because the integrity of the reservoir has to be protected. Nonetheless refracking represents an important implementation of technology that has potentially far reaching effects for the oil price.

Commentary tends to focus on the geopolitics of oil and it is definitely important. Saudi Arabia pumping at near capacity in an attempt to recapture market share is a major event. The fact the USA is less active in the Middle East might also be seen as a symptom of the fact it no longer needs to be as concerned with what happens elsewhere because the domestic market is approximating self-sufficiency.

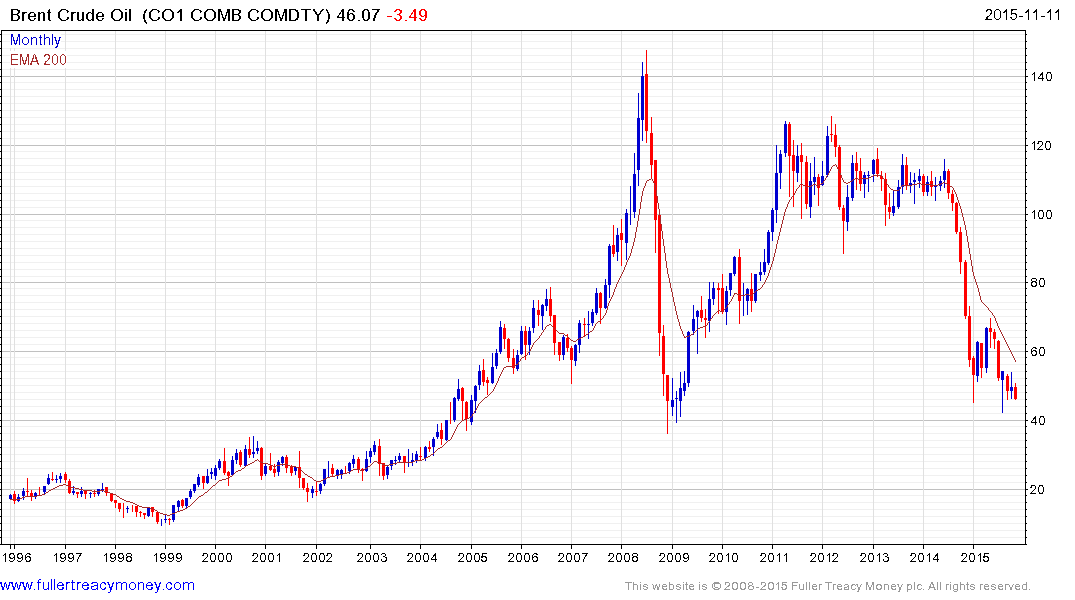

From a technical perspective the $40 area was a previous area of resistance and has offered support over the last decade. Technological factors have the potential to ensure technical rallies are not sustained suggesting a potentially lengthy period of support building and ranging is more likely than not. The big question is where prices will encounter resistance following the first significant rally. If natural gas’ represents a potential template and I believe it does, there could be some wild intra-range swings but prices remain at a fraction of their peak values.

Major oil shares such as Exxon Mobil (Est P/E 20.93, DY 3.55%), Chevron (Est P/E 27.31, DY 4.59%) and ConocoPhillips (Est P/E N/A, DY 5.43%) experienced an impressive rally between August and last week and closed deep overextensions relative to their respective 200-day MAs in the process. Some consolidation of those gains now looks likely but breaks in the short-term progressions of higher reaction lows would be required to signal a lengthier process of support building.