Virtual Reality Is Not Just About Games: Nongaming applications sneak up on an unsuspecting public

This article by Christopher Mims for the Wall Street Journal may be of interest to subscribers. Here is a section:

Eoin Treacy's view -Imagine a version of Google Maps that doesn’t end at the front door of buildings, or an Instagram consisting of immersive experiences rather than snapshots.

“Immersive 3-D content is the obvious next thing after video,” Facebook CEO Mark Zuckerberg said during a recent earnings call.

All of this is possible because, like the PC and the smartphone, virtual reality isn’t so much a single technology as the happy coincidence of a bunch of related ones. Motion tracking, 3-D capture, ultra-high-resolution displays, fast graphics chips and a deep library of 3-D software developed for games and other applications are coming together at just the right time. Google, Facebook, Sony, HTC, Microsoft and countless smaller competitors have already made public their plans for VR, and given its hiring and patents in the area, it’s likely Apple is working on it too.

VR is a technology that is truly in its infancy, despite decades of work in academia, industry and the military. Rapid progress in frame rates, displays, interfaces and more realistic rendering are already in everyone’s development pipeline.

“Keep in mind, this is just the Atari 2600 of VR,” says Cymatic Bruce, head of developer relations at Altspace VR, as he helps me take off a bulky headset I wore to experiment inside the company’s VR play space.

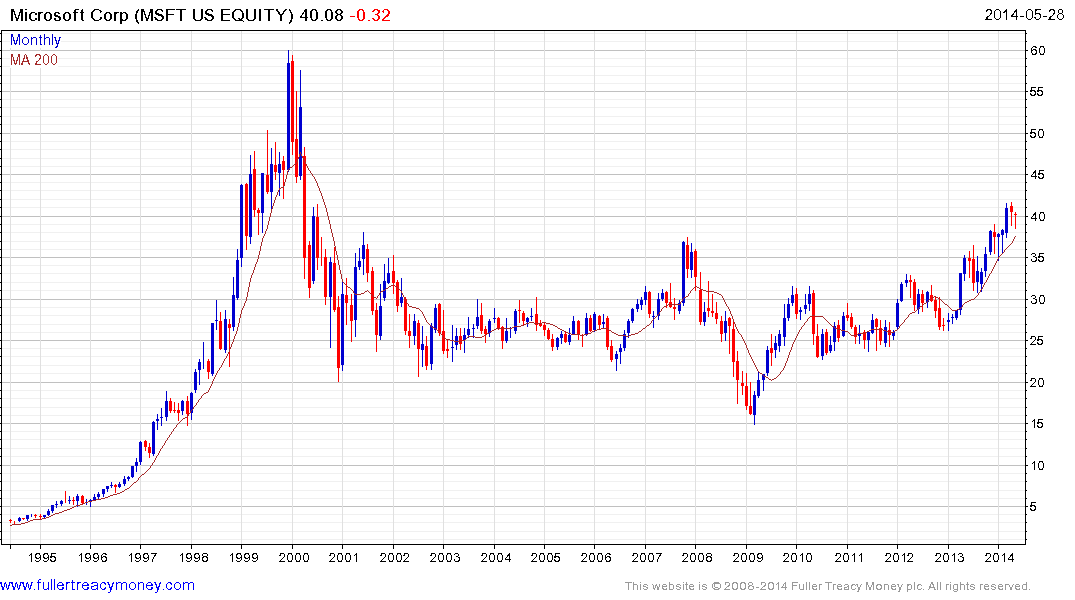

Microsoft’s release of Windows 10 appears to represent a change of focus for the software company since the product is now free but comes with a suite of features aimed at encouraging spending. The purchase of Minecraft last year and bundling an Xbox controller with every Oculus Rift when they are eventually shipped represent additional insights suggesting Microsoft sees its future as a media enabling platform rather than simply a spreadsheet builder and user interface.

This section continues in the Subscriber's Area. Back to top

.png)