The problem? Department stores aren’t drawing the same foot traffic. Though the job market is improving and the U.S. economy is chugging along, Americans would rather spend their money elsewhere. Nordstrom’s results sent its shares down as much as 22 percent in early trading on Friday, following a similar swoon for Macy’s after it released weak earnings earlier this week.

“It’s kind of bizarre,” said Dorothy Lakner, an analyst at Topeka Capital Markets in New York. “People have money. The economy isn’t bad, but they’re not spending on apparel.”

Nordstrom’s stock tumbled as low as $49.75 in premarket trading in New York. The shares had already slid 20 percent this year through the close of regular trading Thursday.

Cautious Outlook

Even J.C. Penney Inc., which beat sales estimates in the third quarter, is approaching the holiday cautiously. The retailer didn’t raise its annual guidance despite posting a same-store sales gain of 6.4 percent last quarter. That exceeded the 4.5 percent increase analysts expected.

J.C. Penney shares fell as much as 11 percent to $7.82 in early trading on Friday. The company, benefiting from a turnaround plan, had gained 36 percent this year through Thursday.

Retailers and clothing suppliers have struggled to pare down excess inventories, forcing them to rely more on discounts.

Nordstrom’s results reflected softer sales “across channels and merchandise categories,” the Seattle-based company said.

“It’s just a traffic problem," James Nordstrom, president of stores, said on a conference call. “We’ve got less people buying clothes this quarter than we expected.”

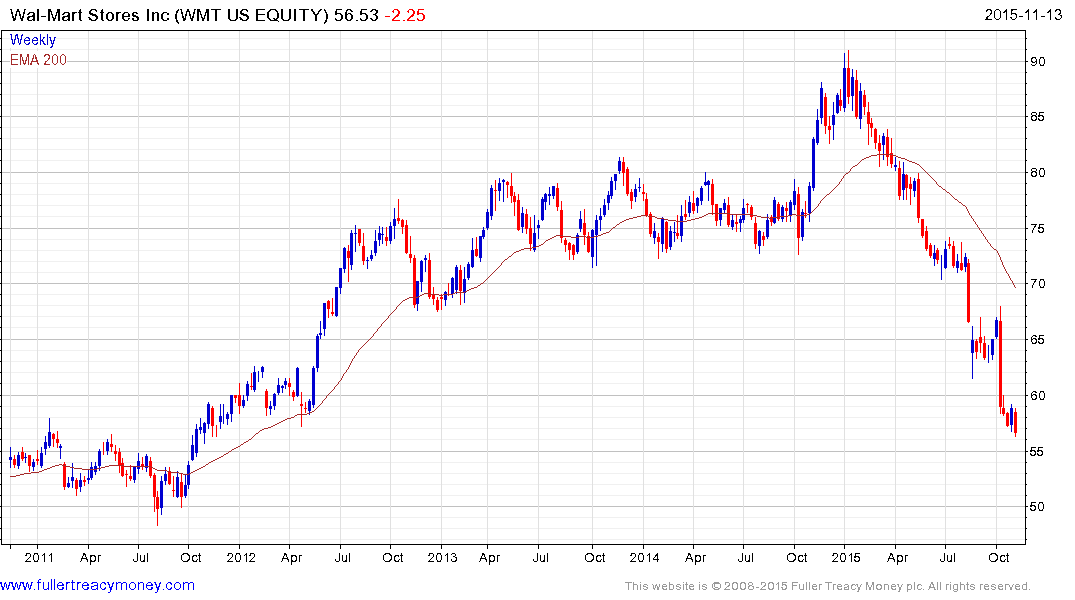

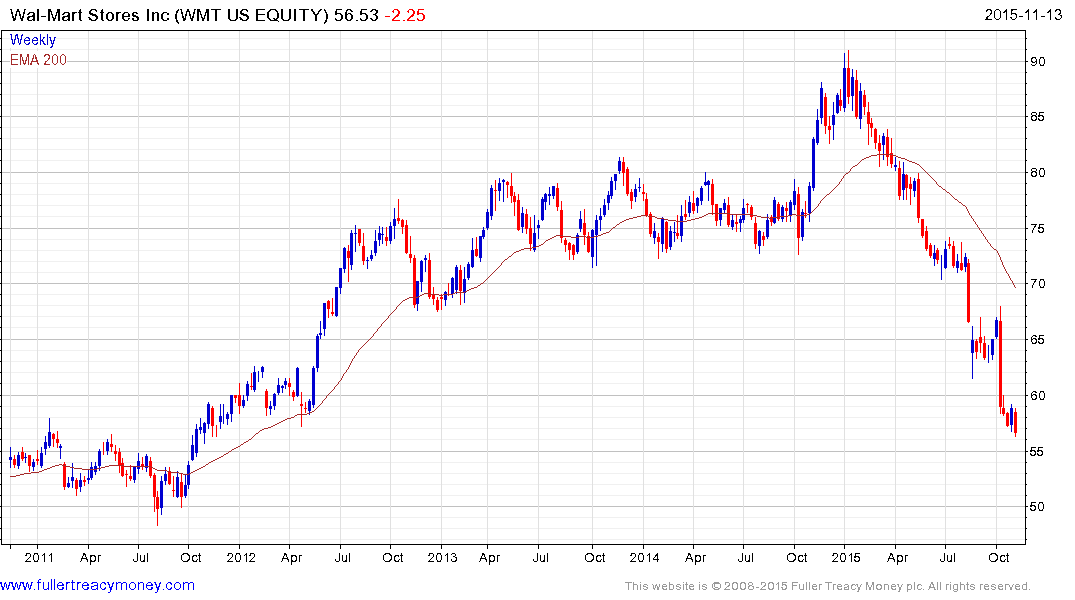

Eoin Treacy's view - Wal-Mart, Macy’s and Nordstrom have come through with earnings that took analysts by surprise and their respective shares have experienced sharp declines as a result. TJX and Ross Stores have also been affected as pessimism about their earnings announcements next week increases.

These declines are raising big questions. Are retailers suffering because they were overenthusiastic and built up inventory to unsustainable levels? Is it because shoppers are not spending due to insufficient funds or are they choosing to purchase elsewhere? Has online grown to such an extent that shopping at department stores is passé? Are consumers already pricing in the potential impact of a Fed rate hike? Considering how accustomed consumers are to being offered deals are they simply waiting for better prices ahead of the holiday season?

This section continues in the Subscriber's Area.

Back to top

.png)