Gold Heads for Biggest Drop in Seven Years on Rising U.S. Yields

This article by Justina Vasquez for Bloomberg may be of interest to subscribers. Here is a section:

Eoin Treacy's view -“Today real rates clearly moved higher and that’s clearly what moved gold lower,” Michael Widmer, head of metals research at Bank of America Merrill Lynch, said by phone from London.

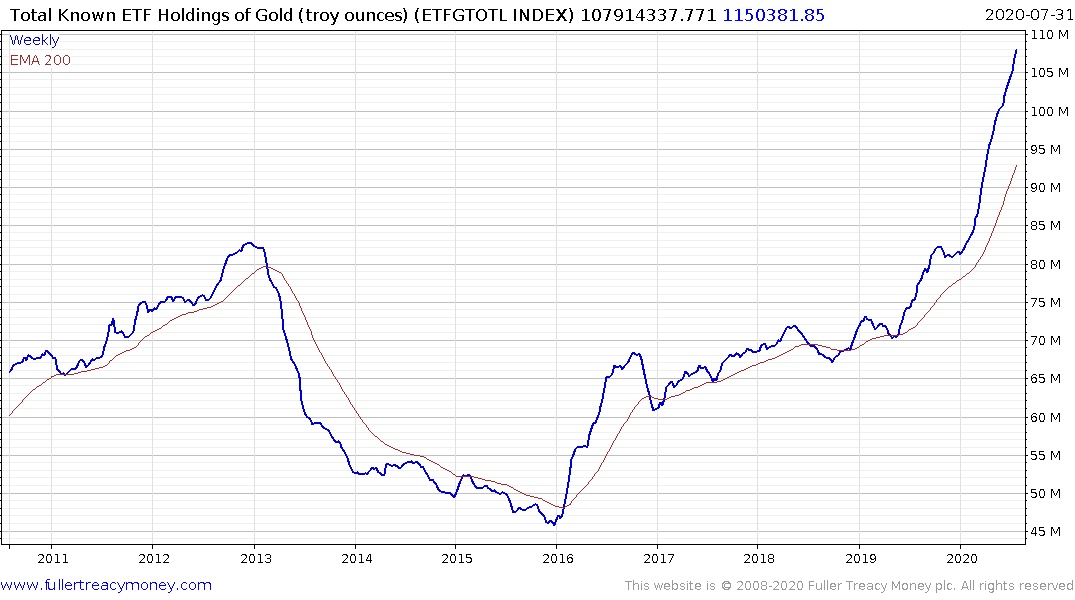

“You had stronger PPI data out and I think when that data came out the market had another look at rates and expectations.” Exchange-traded fund investors also took a breather, seeing back-to-back outflows for the first time since June. On Friday, State Street Corp.’s SPDR Gold Shares, the largest gold-backed ETF, saw its biggest outflow since March. Meanwhile, a Bloomberg Intelligence gauge of senior gold miners dropped the most intraday since March, down as much as 5.7%.

From a medium-term perspective gold does best in a negative real interest rate environment. The inverse correlation between TIPS yields and gold over the last two months has been very tight because investors have been actively seeking a hedge against devaluation of purchasing power.

This section continues in the Subscriber's Area. Back to top