Tesla choice of Nevada for gigafactory boon to NV mining

This article by Dorothy Kosich for Mineweb may be of interest to subscribers. Here is a section:

The plant is expected to begin production of 500,000 lithium battery packs by 2017 for use in Tesla’s Model 3 cars.

John Boyd, a principal of the site selection firm The Boyd Company, told the Wall Street Journal, “I think the single most important factor is the [site’s] low-cost green power, including solar, wind and geothermal energy for the plant. He also cited Nevada’s lack of corporate and personal income taxes as positive factors.

Elon Musk, Tesla CEO, said the company has a commitment from Panasonic Corp, which already supplies batteries for Tesla’s Model S, to help run the battery cell-making operations and underwrite some of the costs.

Located near the former Sleeper Gold Mine in Humboldt County, Nevada, the Western Lithium’s King Valley project is often promoted thusly: “Nevada is uniquely positioned to support the world-wide increase in renewable energy production and demand for electric vehicles through lithium mining—the key ingredients to the high-performance batteries, which will power electric vehicles and be used in utility-scale energy storage projects.”

When the lithium battery gigafactory reaches full production it will represent a significant supply increase for the global sector which will put higher cost battery producers under pressure. Economies of scale should also help to ensure that the market for lithium batteries will also continue to grow.

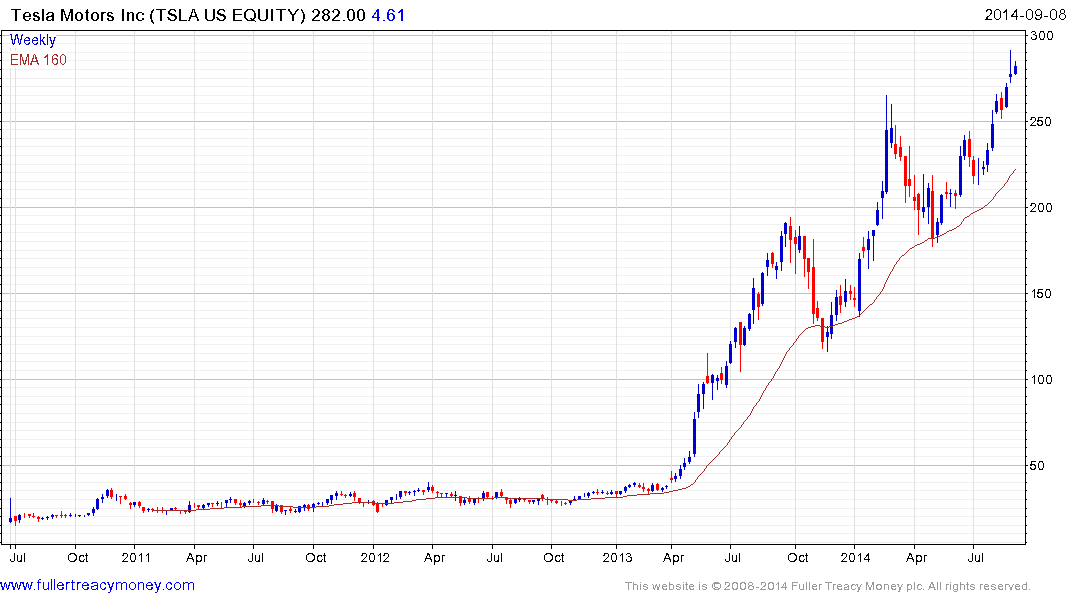

Tesla Motors has moved into a more volatile uptrend following its significant breakout in mid-2013 and hit another new high last week. Some consolidation is looking increasingly likely but a sustained move below the 200-day MA would be required to question the consistency of the medium-term uptrend.

Panasonic more than doubled in 2013, found support in the region of the 200-day MA over the summer and remains on a recovery trajectory.

Among the lithium miners which have recently demonstrated a return to demand dominance two Canadian listed companies are worthy of mention.

Western Lithium USA has held a progression of higher reaction lows for the last year and a sustained move below the 200-day MA would be required to question medium-term scope for additional upside.

Lithium Americas Corp pushed back above the 200-day MA last week to break the almost four-year progression of lower rally highs.

Back to top