New York Fed-Backed Yield Curve Is Set to Invert by September

This article from Bloomberg may be of interest to subscribers. Here is a section:

At the end of May, the latest available data, the New York Fed’s recession gauge showed only a 4% probability of an economic contraction in the next 12 months. But if the forward market has it right, the model will signal a surging odds of a downturn soon enough. According to the New York Fed, the yield curve has predicted essentially every US recession since 1950 with only one false signal in 1967.

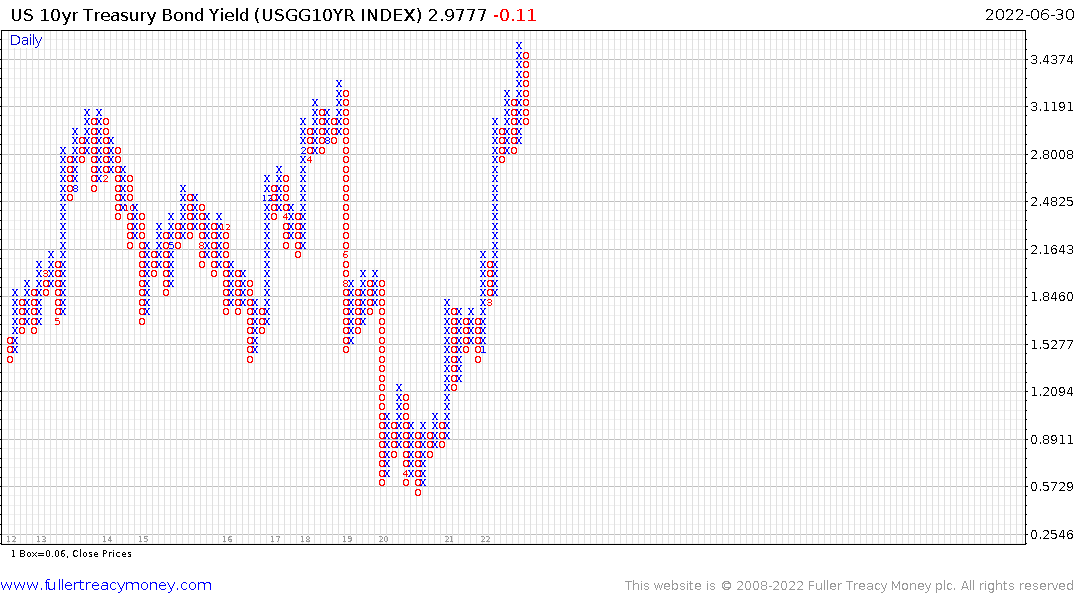

In the underlying spot market, the 10-year yield is still more than 100 basis points above Treasury bills -- but traders in the forward market expect interest rates will be hiked into restrictive economic territory before the year is out.

Fed fund futures suggest Powell will raise borrowing costs by a total of about 125 basis points in July and September to close to 3%, around the highest since 2008.

The predictive ability of the yield curve has stirred debate, and Powell has downplayed its significance. In March, he noted the metric he was more inclined to look at is the difference between bets on where the three-month rate will be in 18 months’ time and that same rate today.

The simple message from the bond market is if the Fed follows through on raising rates by another 175 basis points a recession is inevitable. Then comes the job of pricing in whether that is in fact likely.

So far, the Fed is talking tough. Only last week Jay Powell talked about reducing the size of the balance sheet by between $2 and $3 trillion. Every other example of balance sheet tightening we have seen globally has resulted in deflationary fears spiking so it is a useful anti-inflationary tool.

So far, the Fed is talking tough. Only last week Jay Powell talked about reducing the size of the balance sheet by between $2 and $3 trillion. Every other example of balance sheet tightening we have seen globally has resulted in deflationary fears spiking so it is a useful anti-inflationary tool.

It would also play havoc with every manner of leveraged trade in the world, which is why so much volatility is evident in stocks, bonds, commodities, crypto and private assets.

Bread Financial Holdings is an interesting vehicle. It used to be Alliance Data Service and still offers private label credit card services to 167 retailers. As such it is one of the biggest purveyors of interest free credit deals in the market. The share is trending lower and is rapidly approaching the 2020 lows.

Bread Financial Holdings is an interesting vehicle. It used to be Alliance Data Service and still offers private label credit card services to 167 retailers. As such it is one of the biggest purveyors of interest free credit deals in the market. The share is trending lower and is rapidly approaching the 2020 lows.

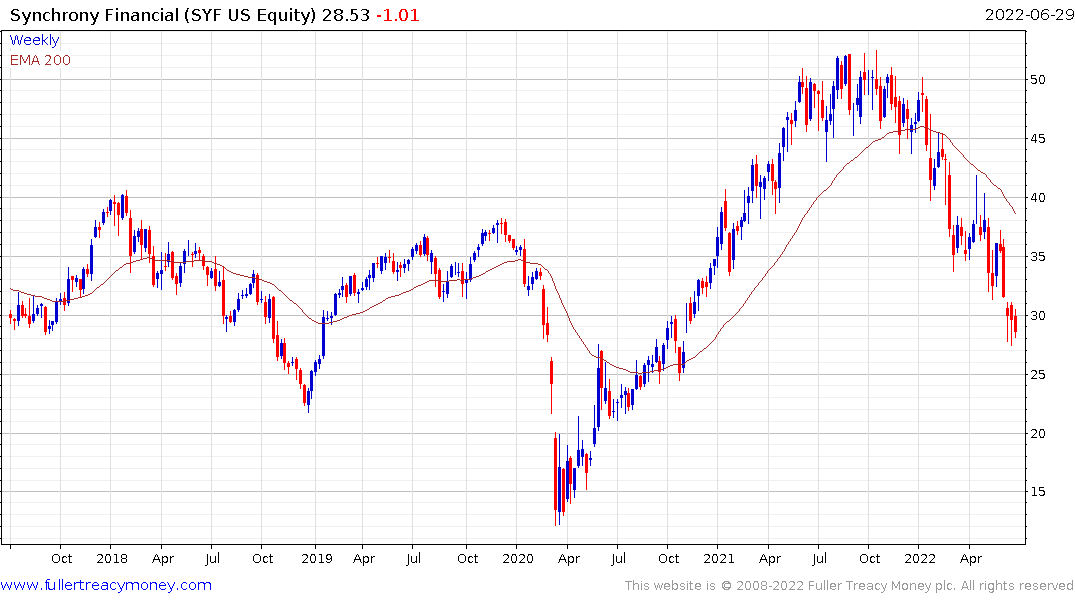

Synchrony Financial and Discover Financial are both also trending lower.

Buy-now-pay-later company Affirm remains weak even after a 90% decline.

Buy-now-pay-later company Affirm remains weak even after a 90% decline.

These companies are consumer facing. Their significant underperformance supports the view consumers are already feeling the effects of tight monetary conditions.

.png)

The weakness of bitcoin is only going to add further pressure to many retail investors.

All other factors being equal, recessions fuel a flight to quality. That generally means buying long-dated bonds. At present everyone is seriously concerned about inflation, but we know central bank balance sheet contraction is deflationary. 10-year yields are back below 3%. There is a clear possibility we are looking at another failed break above 3%.

One of the most troubling factors for “diversified” investors this year has been the positive correlation between bond prices and stocks. They have both been falling together. Risk parity and the 60/40 portfolio model have misfired so far this year.

The reason for the correlation is linked to leverage. When interest rates are close to zero valuations can inflate to infinity. The reintroduction of a discount rate brings valuations back to earth but higher rates also weigh on bonds. Rising inflationary expectations have exacerbated the effect on bonds which has strengthened the positive correlation.

.png)

As bonds rebound, the Nasdaq-100 is putting in a higher reaction low today. That suggests scope for an additional reversionary rally ahead of Q2 earnings. To break the positive correlation, earnings and guidance will need to disappoint, which would push up valuations, weigh on stock prices and make bonds more attractive.